May 7th, 2018 | Market Watch

Cash-Flow vs. Equity – Striking a Balance

Houses vs Condos: Now and Then

Let’s take a step back when condos were associated with cash-flow and houses with equity. You may already know that, but why?

Condos were cheaper, but rent yield was high in select pockets and this would drive good mth/mth cash-flow. On the other hand, houses were more expensive compared to condos – so would carry higher mth/mth, therefore there wouldn’t be much left after the mortgage payment and operating expenses.

What’s Happening Today?

Cash-flow and equity really depend on the specific situation.

The gap between condos & houses has narrowed significantly. This means that condo’s cash-flow is not as lucrative as it once was. Moreover, both can be good investments, but we believe land will always prevail from an equity perspective in the long run.

But there are some exceptions!

Condos in certain pockets – as those pockets only have so much “land.” Indeed, scarcity is the name of the game while considering the fundamentals of a good condo investment (i.e. location first, amenities, transit, infrastructure, proximity to restaurants, bars, etc)

Let’s Strike a Balance

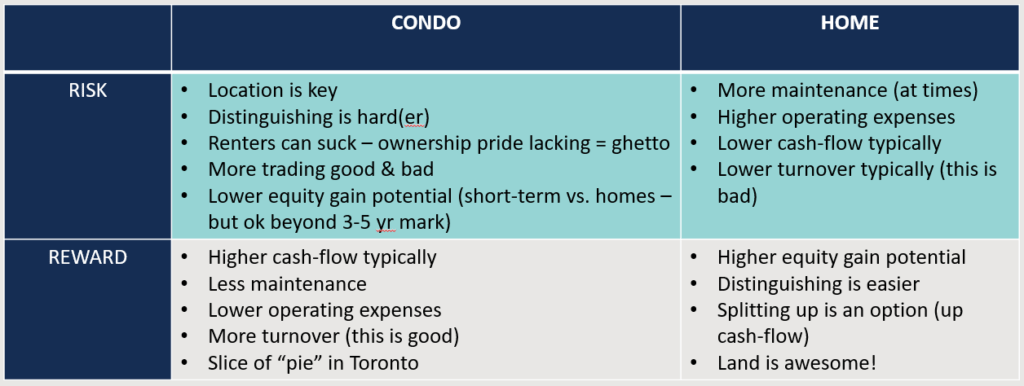

Let’s take a look at some of the pros and cons of both house & condo ownership as an Investor.

Other Seminar Notes:

Preconstruction vs Resales – Benefits and Pitfalls

“Mini” or “Container” homes – Are they a thing?

Want to stay up to date on the market? Sign up to receive monthly neighbourhood reports, with sold prices, into your inbox. It’s that easy!